-

On April 25, 2019, the Director denied Fastbucks Holding Corporation’s request to set aside or modify three CIDs seeking information as to whether Fastbucks and its lenders had violated the Equal Credit Opportunity Act, the Fair Credit Reporting Act, or had engaged in unfair, deceptive or abusive acts or practices in violation of the Consumer Financial Protection Act.[1] There, Fastbucks alleged that “harass[ing] and taunt[ing]” messages, which were allegedly sent via social media by an individual at the CFPB to the company’s CEO, showed the CID had been issued for an improper purpose. Fastbucks argued in its petition that prior Acting Director Mick Mulvaney had vowed that the CFPB would conduct itself with “humility and prudence,” and the investigation of Fastbucks had hallmarks that contradicted such a humble or prudent approach. Director Kraninger denied the petition, standing by the Enforcement staff, and asserting that the agency as an entity did not improperly issue the CID notwithstanding the petitioner’s concern regarding the behavior of one CFPB employee.

-

The same day, CFPB issued an Order concerning the petition filed by Fair Collections and Outsourcing, Inc., et al., which asserted among other things that the CID was invalid because the CFPB was unconstitutional. The Director rejected that argument, as well, and enforced the CID.

-

On May 21, 2019, the Director similarly denied a petition to set aside or modify a CID that had been issued to Synchrony Financial (formerly, GE Capital). Such CID stated that the purpose of the CFPB’s investigation was to determine whether banks (or card issuers) had committed misleading advertising, wrongful payment-allocation, or other untoward practices in connection with deferred-interest financings on consumer credit cards.[2] Despite finding that Synchrony “failed to demonstrate the sort of burden that would justify setting aside or modifying the CID,” the CFPB modified the CID in a narrow fashion unlike the consequences of what would occur in a negotiated meet-and-confer process, i.e., the CFPB limited the scope of certain requested items and extended deadlines.[3]

-

On September 6, 2019, the Director likewise denied a petition to set aside or modify a CID against the Center for Excellence in Higher Education (CEHE).[4] CEHE argued that complying with the CID was unduly burdensome, and that seeking testimony as to “every aspect” of the company’s student loan program was unreasonable. The Director rejected this argument and issued an order compelling compliance with the CID. Notably, the Director decided in favor of the CFPB and against CEHE, a nonprofit organization that was alleged to have offered student loans, notwithstanding some outcry among advocates that the CFPB’s recent appointment of a Private Education Loan Ombudsman (who formerly served as a top official at a loan servicer) was a harbinger that the CFPB would no longer protect the interests of student borrowers. Director Kraninger’s petition denial suggests the contrary.

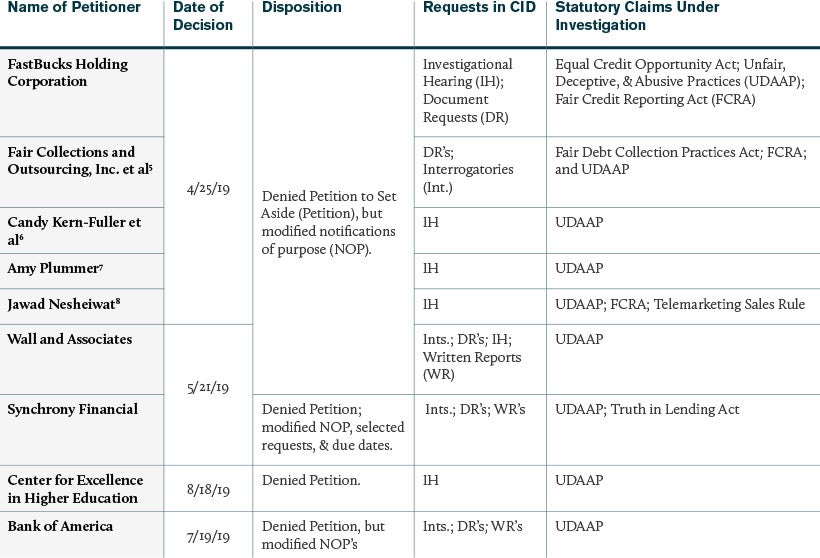

Below we provide a graph detailing the outcome of the remaining cases not discussed above in our case summaries, or in our prior blog post about Bank of America.

Director Kraninger’s Petition Decisions in 2019

[5], [6], [7], [8]

Four Strategic Takeaways from Petition DenialsFirst, the decisions, including the CEHE and Fastbucks decisions,[9] indicate that the CFPB and state attorneys general are furthering their shared objective to coordinate investigations. Accordingly, Director Kraninger’s tenure thus far demonstrates that the CFPB has not changed its protocol of pursuing deliberate state-federal joint investigations of consumer financial protection violations. While popular press have been reporting that federal enforcement agencies under the current administration have been defanged, leaving a void into which state agencies have stepped up, the plain facts (and the docket of petition denials at the CFPB) indicate that—in actuality—federal-state coordination of investigations remains robust, consistent with the CFPB’s mission.

Second...