Garnishment issues are recurring indications of financially distressed companies and individuals. In fact, a bank account garnishment may be the event that precipitates a bankruptcy filing.

A. Garnishment Basics

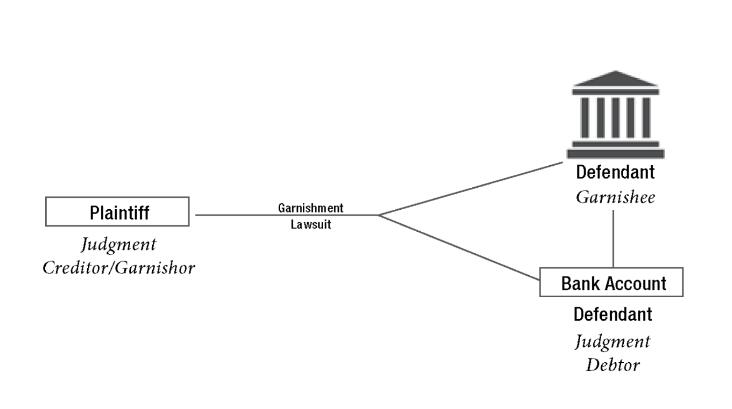

A garnishment is a judicial proceeding that involves three parties: a plaintiff and two defendants. The plaintiff is the judgment creditor, who is holding a judgment and seeking payment (called the "garnishor"). The defendants are the judgment debtor (who owes money to the creditor) and the debtor's bank (called the "garnishee"). Post-judgment, the gar-nishor names both the debtor and the garnishee in a garnishment proceeding and demands that the garnishee turn over any funds in the debtor's account(s) to the garnishor. Both the debtor and the garnishee may file responses. The garnishee's response typically states whether it holds assets belonging to the debtor (i.e., funds), and whether the garnishee itself claims an interest in the funds. Objections raised in the debtor's response could include that the judgment was satisfied or that the funds in the account are exempt.166

If the court rules in favor of the garnishor, it directs the garnishee to pay funds in the debtor's bank account over to the garnishor; if the garnishee fails to do so (absent defenses or set-offs), the garnishee becomes liable to the garnishor for the amount of the funds. To prevent dissipation of funds before the court rules, a garnishee generally freezes its customer's account after it is served with a garnishment. Because freezing the account renders the funds inaccessible to the debtor, who may need the funds to operate, a garnishment can precipitate a bankruptcy filing to free the funds.

Garnishment is a state law remedy, and nearly all garnishment suits are filed in state court. The determination of the relative rights of the parties to a garnishment in bankruptcy thus requires consideration of state law.

B. Garnishments Before Bankruptcy

1. The Bank as Garnishee

As a garnishee, the bank's role in the garnishment proceedings is generally neutral. It freezes the funds, files a response to the garnishment petition, and awaits a decision from the court about the funds.167

The garnishee bank may need to take a more active role when the debtor files a bankruptcy case. Once a state court receives notice of the bankruptcy, it may stay the garnishment proceeding. However, because the garnishment proceeding is also a lawsuit against the bank, a mere stay of the case might not fully protect the bank from damages, as the bank is still a defendant in the lawsuit. The case law is not uniform on the issue of whether the garnishor may continue to prosecute an independent claim for damages against the garnishee when the debtor has filed for bankruptcy. Bankruptcy courts have held, alternatively, that the garnishor may pursue an independent claim against the garnishee, that the application of the automatic stay to the garnishment action precludes further action against the garnishee, or that the garnishee is protected by the automatic stay only in certain circumstances.168 In light of this uncertainty, from the perspective of the garnishee, seeking dismissal of the entire garnishment proceeding is preferable to seeking a stay of the proceedings.

As the garnishee, the bank may also find itself caught in the middle of a dispute between its customer and the garnishor about the release of the funds. The garnishor might refuse to release the garnishee or dismiss the garnishment after it learns about the debtor's bankruptcy case. At the same time, the debtor (also the bank's customer) could demand that the garnishee release the funds. If the state court has...